A fascinating article from The Conversation.

ooOOoo

Earth-size stars and alien oceans – an astronomer explains the case for life around white dwarfs

Juliette Becker, University of Wisconsin-Madison

The Sun will someday die. This will happen when it runs out of hydrogen fuel in its core and can no longer produce energy through nuclear fusion as it does now. The death of the Sun is often thought of as the end of the solar system. But in reality, it may be the beginning of a new phase of life for all the objects living in the solar system.

When stars like the Sun die, they go through a phase of rapid expansion called the Red Giant phase: The radius of the star gets bigger, and its color gets redder. Once the gravity on the star’s surface is no longer strong enough for it to hold on to its outer layers, a large fraction – up to about half – of its mass escapes into space, leaving behind a remnant called a white dwarf.

I am a professor of astronomy at the University of Wisconsin-Madison. In 2020, my colleagues and I discovered the first intact planet orbiting around a white dwarf. Since then, I’ve been fascinated by the prospect of life on planets around these, tiny, dense white dwarfs.

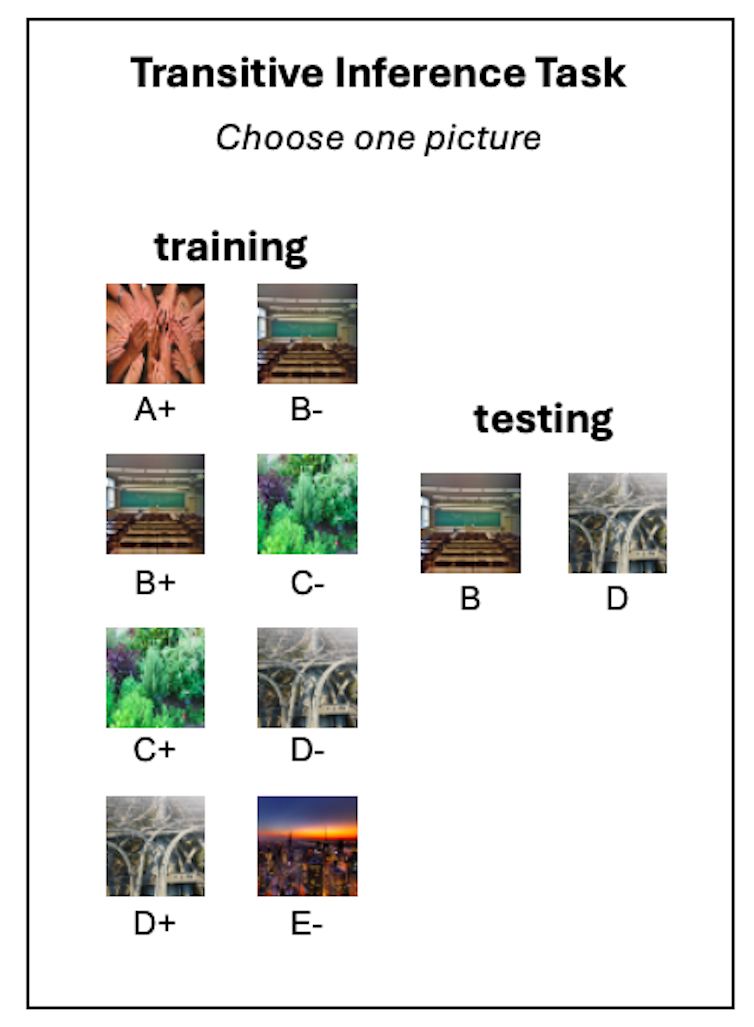

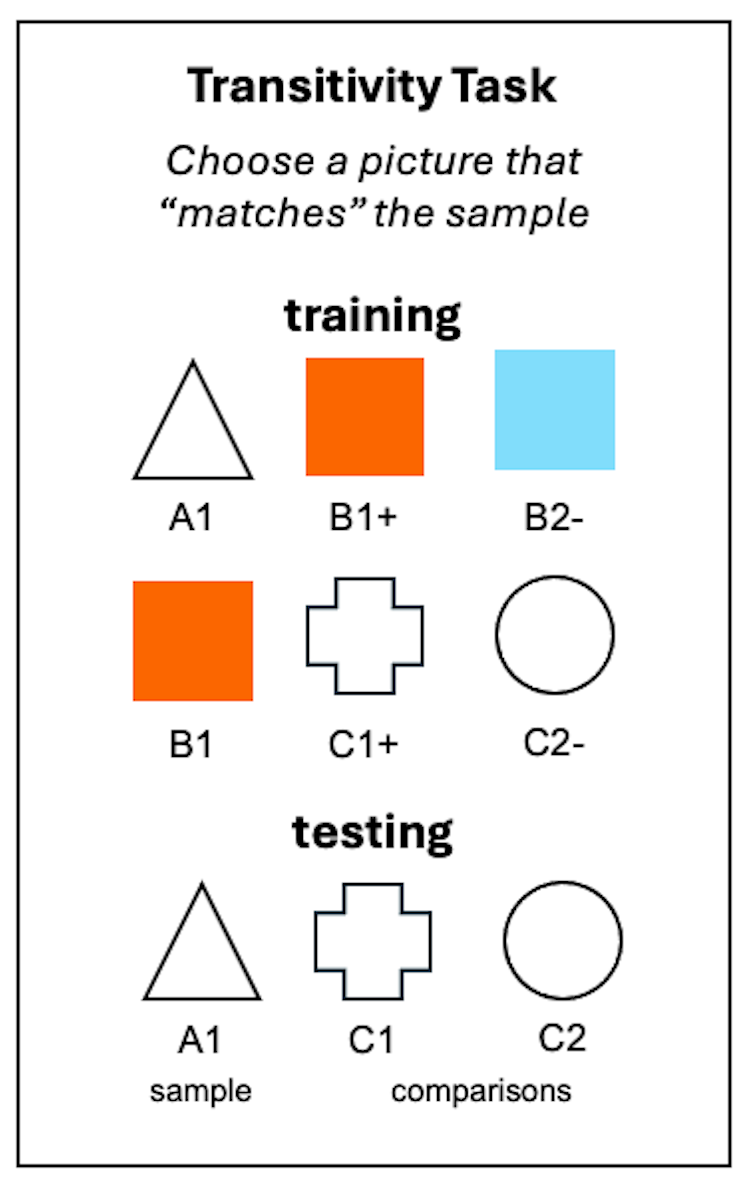

Researchers search for signs of life in the universe by waiting until a planet passes between a star and their telescope’s line of sight. With light from the star illuminating the planet from behind, they can use some simple physics principles to determine the types of molecules present in the planet’s atmosphere.

In 2020, researchers realized they could use this technique for planets orbiting white dwarfs. If such a planet had molecules created by living organisms in its atmosphere, the James Webb Space Telescope would probably be able to spot them when the planet passed in front of its star.

In June 2025, I published a paper answering a question that first started bothering me in 2021: Could an ocean – likely needed to sustain life – even survive on a planet orbiting close to a dead star?

A universe full of white dwarfs

A white dwarf has about half the mass of the Sun, but that mass is compressed into a volume roughly the size of Earth, with its electrons pressed as close together as the laws of physics will allow. The Sun has a radius 109 times the size of Earth’s – this size difference means that an Earth-like planet orbiting a white dwarf could be about the same size as the star itself.

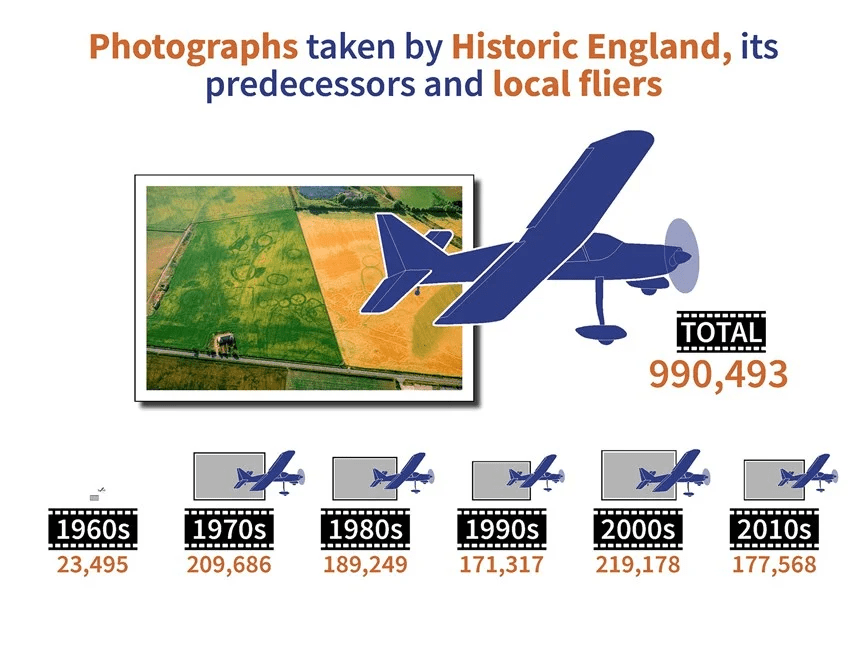

White dwarfs are extremely common: An estimated 10 billion of them exist in our galaxy. And since every low-mass star is destined to eventually become a white dwarf, countless more have yet to form. If it turns out that life can exist on planets orbiting white dwarfs, these stellar remnants could become promising and plentiful targets in the search for life beyond Earth.

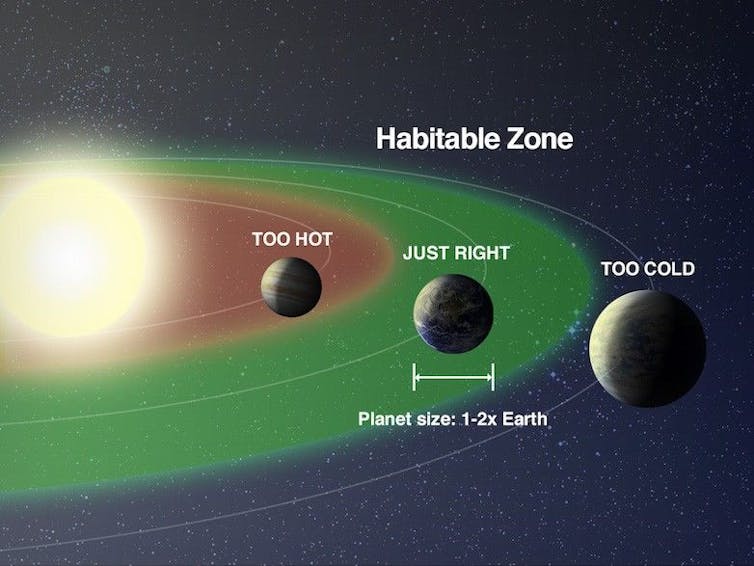

But can life even exist on a planet orbiting a white dwarf? Astronomers have known since 2011 that the habitable zone is extremely close to the white dwarf. This zone is the location in a planetary system where liquid water could exist on a planet’s surface. It can’t be too close to the star that the water would boil, nor so far away that it would freeze.

The habitable zone around a white dwarf would be 10 to 100 times closer to the white dwarf than our own habitable zone is to our Sun, since white dwarfs are so much fainter.

The challenge of tidal heating

Being so close to the surface of the white dwarf would bring new challenges to emerging life that more distant planets, like Earth, do not face. One of these is tidal heating.

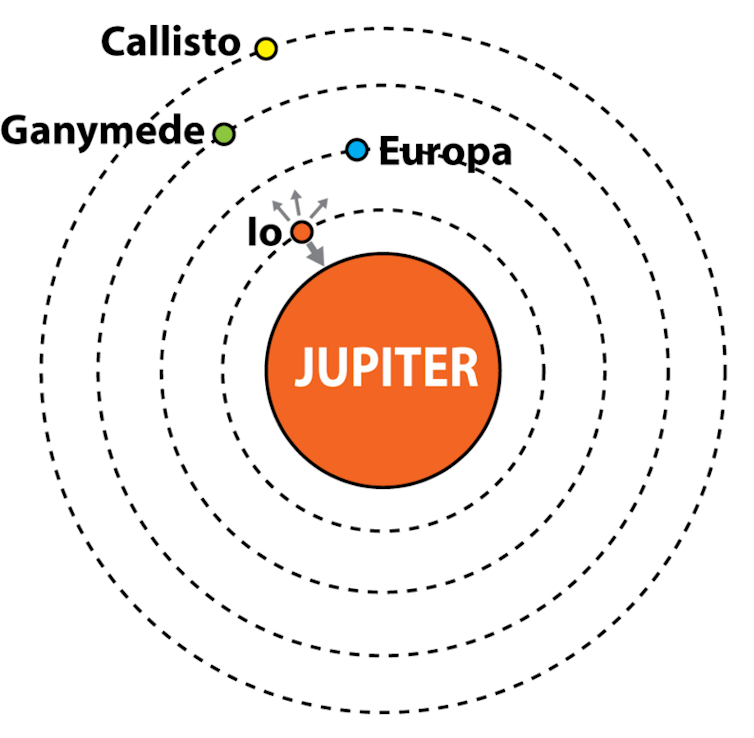

Tidal forces – the differences in gravitational forces that objects in space exert on different parts of a nearby second object – deform a planet, and the friction causes the material being deformed to heat up. An example of this can be seen on Jupiter’s moon Io.

The forces of gravity exerted by Jupiter’s other moons tug on Io’s orbit, deforming its interior and heating it up, resulting in hundreds of volcanoes erupting constantly across its surface. As a result, no surface water can exist on Io because its surface is too hot.

In contrast, the adjacent moon Europa is also subject to tidal heating, but to a lesser degree, since it’s farther from Jupiter. The heat generated from tidal forces has caused Europa’s ice shell to partially melt, resulting in a subsurface ocean.

Planets in the habitable zone of a white dwarf would have orbits close enough to the star to experience tidal heating, similar to how Io and Europa are heated from their proximity to Jupiter.

This proximity itself can pose a challenge to habitability. If a system has more than one planet, tidal forces from nearby planets could cause the planet’s atmosphere to trap heat until it becomes hotter and hotter, making the planet too hot to have liquid water.

Enduring the red giant phase

Even if there is only one planet in the system, it may not retain its water.

In the process of becoming a white dwarf, a star will expand to 10 to 100 times its original radius during the red giant phase. During that time, anything within that expanded radius will be engulfed and destroyed. In our own solar system, Mercury, Venus and Earth will be destroyed when the Sun eventually becomes a red giant before transitioning into a white dwarf.

For a planet to survive this process, it would have to start out much farther from the star — perhaps at the distance of Jupiter or even beyond.

If a planet starts out that far away, it would need to migrate inward after the white dwarf has formed in order to become habitable. Computer simulations show that this kind of migration is possible, but the process could cause extreme tidal heating that may boil off surface water – similar to how tidal heating causes Io’s volcanism. If the migration generates enough heat, then the planet could lose all its surface water by the time it finally reaches a habitable orbit.

However, if the migration occurs late enough in the white dwarf’s lifetime – after it has cooled and is no longer a hot, bright, newly formed white dwarf – then surface water may not evaporate away.

Under the right conditions, planets orbiting white dwarfs could sustain liquid water and potentially support life.

Search for life on planets orbiting white dwarfs

Astronomers haven’t yet found any Earth-like, habitable exoplanets around white dwarfs. But these planets are difficult to detect.

Traditional detection methods like the transit technique are less effective because white dwarfs are much smaller than typical planet-hosting stars. In the transit technique, astronomers watch for the dips in light that occur when a planet passes in front of its host star from our line of sight. Because white dwarfs are so small, you would have to be very lucky to see a planet passing in front of one.

The transit technique for detecting exoplanets requires watching for the dip in brightness when a planet passes in front of its host star.

Nevertheless, researchers are exploring new strategies to detect and characterize these elusive worlds using advanced telescopes such as the Webb telescope.

If habitable planets are found to exist around white dwarfs, it would significantly broaden the range of environments where life might persist, demonstrating that planetary systems may remain viable hosts for life even long after the death of their host star.

Juliette Becker, Assistant Professor of Astronomy, University of Wisconsin-Madison

This article is republished from The Conversation under a Creative Commons license. Read the original article.

ooOOoo

I take my hats off to the researchers that are looking for life elsewhere.