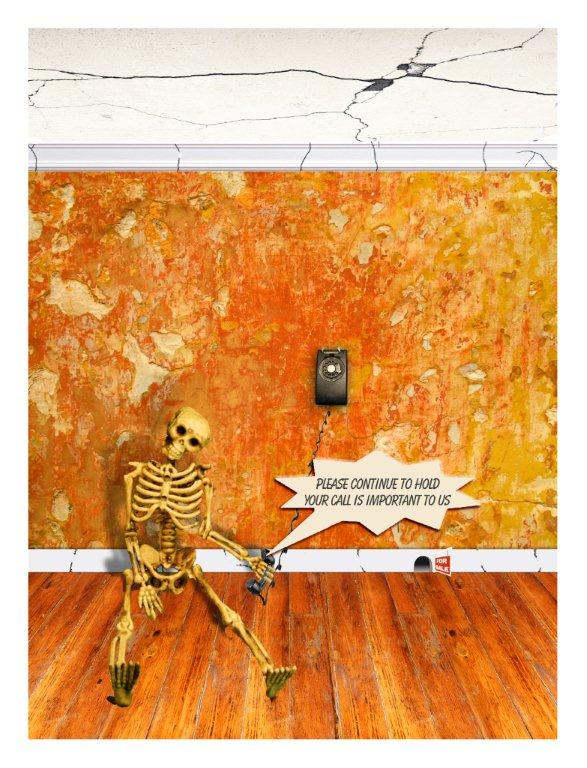

A Sunday smile from Neil Kelly

Year: 2011

Your call is so, so important to us!

A delightful trawl by Neil Kelly through the call centre industry.

Are there any more annoying phrases in the English language than “your call is important to us“, or “we are experiencing particularly high call volumes“?

In 2007 companies worldwide spent some $280 billion on outsourced call-centre services, according to NASSCOM, a call-centre trade group in Delhi. Much of India’s call-centre industry, which employs roughly 300,000 agents, is located outside the ring road that encircles Bangalore, in a string of smart new business parks with tidy lawns and private security. Were it not for the stray dogs, a visitor could be forgiven for mistaking the area for Silicon Valley.

Meanwhile in Australia …

Meanwhile …… back in Wales in the United Kingdom … listen to this call centre handling a complaint from an ASDA customer – listen right to the end!

Thanks to David from neatorama.com I was able to put together a medley of hold music and without resorting to The Four Seasons! Hope to have The Top Twenty Hold Music Songs out in time for Christmas.

Click on this link hold music medley to listen to that medley.

Finally, you may be interested in reading Your Call Is Important to Us: The Truth about Bullshit by Laura Penny which is available as a free eBook here.

The end of an era, part two.

A review of David Kauder’s recently published book, The Greatest Crash.

Details of the availability of the book are included at the end of the review.

Extracts from the book included are with grateful thanks to Sparkling Books.

Part One of this review was published yesterday which needs to be read before Part Two.

——————-

Chapter 5 continues by examining the over-bearing consequences of excessive public spending, excessive Government regulations, substitute taxation, weakness of Treasury forecasts, and so on. While these are UK issues, there is no doubt that similar restraints of free enterprise exist in many other western nations.

In Chapter 6, ‘Group Think‘, David looks at the strange ways in which we form opinions. It’s a topic that has been discussed and written about widely but the point behind this chapter is that people have in great part lost the ability to discern truth from fiction, with terrible implications when it comes to understanding how individuals are affected by government and bureaucratic institutions.

The chapter closes;

One of the remarkable points that I have found in writing this book is that many of the detailed errors, incorrect policies et al, have already been amply documented by others. But we never learn. The delegated society, the strength of lobby groups and vulnerability of our political system to pressure, the sheer volume of noise in the media and on the Internet, the immediacy of the demands of daily life, all combine to make our collective memory rather short.

Amen to that!

Chapter 7, ‘Academic differences of opinion‘, was surprisingly short at just 6 1/2 pages. One would have thought the subject worthy of a much longer review especially as David was exploring the fundamental differences between Keynesian and Ricardian economic theories and opportunities for alternative theories. Must say that that I laughed out loud (David’s book is a little short on humour!) at the sentence on p.127 that ran, “One correspondent writing to the Financial Times proposed that economics should be declared a failing discipline, economists as not fit for purpose, and a physicist put in charge of sorting their theories out.”

Chapter 8, ‘The dark side of capital markets‘, is the penultimate chapter and quite a technical one at that. But David manages to trip through esoteric aspects, well esoteric to the lay reader, in a manner that keeps one involved. Here’s an example from early on in the chapter.

Capital markets follow a long cycle beyond the experience of most practitioners, detectable only by understanding history and then applying this understanding to contemporary conditions.

It didn’t mean much to me. Then the next sentence;

The principles are identical for any market where prices depend on the supply of credit: equities, bonds, property and commodities are all markets where the prices must relate to the availability of credit.

That, at least, was understood but still the penny hadn’t dropped. Then came;

Bond prices prosper when credit is lacking while the other three prosper when credit is abundant.

That then made sense to me but still only at some academic level. David then followed those sentences with these two paragraphs;

The whole market cycle consists of bull market followed by bear market, as surely as night follows day. The bull market in assets is driven by an increasing supply of credit and economic expansion, since more credit leads to higher prices. The bear market in assets is driven by less credit and economic contraction; there is no purchasing power to keep asset prices high. Only fixed interest bonds are contra-cyclical, declining in price as credit expands and rising in price as credit sinks.

There are two useful theories for analysing the whole market cycle: conversion flow and Dow theory.

So in half-a-page of text, the book effectively educated me and then showed the relevance of that learning to the world I was living in. Cleverly done!

Chapter 9, ‘The attitude change‘, is, without doubt, a clincher of a close to this fascinating book. The sentiments conveyed in this chapter are so unexpected that, forgive me, it would be wrong to explicitly refer to them. Buy the book!

Let me just say that the last chapter fully endorsed me calling this review The End of an Era.

Overall conclusions

This is an important book from a writer who has both the academic and professional experience to enable him to form the views that he expresses. Only time will tell if the whole scenario that is envisaged by Mr. Kauders will play out as he expects. My personal view is that it will.

For individuals and business alike, reading The Greatest Crash will inform you in a manner that I would argue is critical when one notes the precarious and potentially unstable period we are living through. The decisions readers make after reading the book are beyond the remit of this review and, of course, David Kauders, but, at least, read the book!

Prof. Myddelton in the book’s introduction wrote, “But one of the things we need now is new thinking on the fundamentals.” Perhaps not new thinking on fundamentals, as the Prof. puts it, but a reinstatement of core fundamental values.

I am not alone from sensing that the world, especially the western world, is transitioning from an era of greed and materialism, seeing a world of unlimited resources, to a different societal relationship with planet Earth, the only planet we have. A transition across all layers of society towards the values of truth, integrity and compassion; values whose day has come.

The Greatest Crash reinforces immensely my notion that this truly is the end of an era.

——————

Want to buy The Greatest Crash? The ebook was published in October worldwide, the paperback published in the UK on the 1st November UK, the hardcover being released any day now in the UK. For North America both the paperback and hardcover versions are being published on 1st February, 2012.

Full details from the Sparkling Books webpage here.

Copyright © 2011 Paul Handover

The end of an era, part one.

A review of David Kauder’s recently published book, The Greatest Crash.

Details of the availability of the book are included at the end of both parts of my review, part two is published tomorrow.

Extracts from the book included are with grateful thanks to Sparkling Books.

Personal introduction.

Back in the late 90s, when I was living in England, I attempted to bolster my self-employed income by investing and trading in equities. It was a frustrating game, game being the right word! One day I was lamenting this to a close friend and he gave me the name of David Kauders at Kauders Portfolio Management and suggested I might like to contact him.

I followed my friend’s recommendation and met with David. What he outlined at that meeting all those years ago was mind-blowing, no other way of putting it. Essentially, David predicted a financial and economic crisis of huge proportions. He convinced me of the likelihood of that crisis and in November 2001 I became a fee-paying client. As the world now knows that prediction came to fruition. My anticipated residency in the USA meant continuing to be a client was not possible, and I ceased being a client of Kauders Portfolio Management in June 2010.

Thus not only am I deeply indebted to my friend for referring me to David but also unable to write this review from an unprejudiced point of view.

The Greatest Crash

The book, released in paperback in England in October 2011, published by Sparkling Books, is subtitled ‘How contradictory policies are sinking the global economy‘. Frankly, that subtitle doesn’t do much for me. A clearer message that comes from the book is this: the economic world has reached a ‘systems limit’. Indeed, the term systems limit is used widely throughout the book.

In his introduction to the book, Professor D. R. Myddelton, Chairman of the Institute of Economic Affairs, writes,

Adam Smith said ‘There’s a deal of ruin in a nation’, and it would be a mistake to despair. But one of the things we need now is new thinking on the fundamentals. That is what David Kauders provides in his book ‘The Greatest Crash’.

Without doubt, David achieves that.

Starting with the first sentence, David sets out the core problem;

This book argues that it is impossible to expand the financial system much further.

expanding this a few paragraphs later,

This is the financial system limit: lack of new borrowing plus excessive weight of debt obligations from past borrowing combine to slow economies down. This is the barrier whichever way policy makers turn. It is like the lid on a boiling kettle. Enough steam can lift it for a while but it always snaps back into place. The financial system limit is a roadblock preventing growth.

A few pages later in this opening chapter ‘The roadblock preventing growth‘ this limit is explained thus,

Policy contradictions also show us that the financial system has reached a roadblock. The glaring conflict between bailout and austerity is at the core. Each bailout or stimulus requires creation of more credit, leading to false financial speculation, and for a short while markets recover their poise. The threat of inflation returns. Later, bad debts rise, the markets tumble again and a new crisis emerges. Austerity, the alternative policy, cuts spending thereby cutting the immediate level of economic activity and bringing economic decline more quickly than the stimulus alternative. Whichever way they turn, the authorities are damned.

In the next chapter, ‘Evolution by trial and error‘, David writes about economic cycles and reminds his readers that the long economic cycle is often “beyond the practical experiences of our working lifetimes“. Then later suggesting that because we have seen the greatest period of inflation ever since the end of World War Two, ergo “the unwelcome lesson from history is that the greatest deflation should follow.”

In Chapter 4, ‘An Era of Wishful Thinking‘, the spotlight is put on the horrific policy errors that have been made for decades, try these three examples (there is a longer list in the book),

- Policy makers believed that debt could expand indefinitely, at no cost.

- Nobody realised that interest rate rises would make existing borrowing unaffordable and cause a wave of defaults.

- The world was swamped with so many detailed requirements and standards that nobody could understand how they all fitted together. It was assumed that ‘transparency’, i.e. extensive detail, would solve the inability to comprehend how the parts made the whole.

Part Two of the review, continuing with Chapter 5 is tomorrow.

Want to buy The Greatest Crash? The ebook was published in October worldwide, the paperback published in the UK on the 1st November UK, the hardcover being released any day now in the UK. For North America both the paperback and hardcover versions are being published on 1st February, 2012.

Full details from the Sparkling Books webpage here.

Copyright © 2011 Paul Handover

Mid-week smile

But first an apology.

Regular readers know that I do try and write something more or less of substance for each day, Monday to Friday. But today, Monday, it is already well into the afternoon and there is nothing yet written for tomorrow. The reason is that I am completing a lengthy review of David Kauders’ fascinating book, The Greatest Crash. Part One to be published on Wednesday, 23rd.

So thanks to Neil Kelly’s delightful way of seeing life, thought you would enjoy this!

Beauty of flight

Big thank you to Dennis L. for forwarding this video

Will say no more – just watch

And if that gives you a buzz, then you might want to read a Post that I published on the 30th July Free as a Bird reproduced in full below,

The wonderful combination of paragliding and flying with hawks.

Thanks to Dan Gomez for passing me a short video about this amazing activity. It was a matter of moments to find out the background. But first a picture.

There’s a full description of the history of parahawking, as it is called, on WikiPedia.

Parahawking is a unique activity combining paragliding with elements of falconry. Birds of prey are trained to fly with paragliders, guiding them to thermals for in-flight rewards and performing aerobatic maneouvres.

Parahawking was developed by British falconer Scott Mason in 2001. Mason began a round-the-world trip in Pokhara, Nepal, where many birds of prey – such as the griffon vulture, steppe eagle andblack kite – can be found. While taking a tandem paragliding flight with British paraglider Adam Hill, he had the opportunity to see raptors in flight, and realized that combining the sport of paragliding with his skills as a falconer could offer others the same experience. He has been based in Pokhara ever since, training and flying birds during the dry season between September and March.

The team started by training two black kites, but have since added an Egyptian vulture and a Mountain hawk-eagle to the team. Only rescued birds are used – none of the birds has been taken from the wild.

There’s an interesting website for those that want to take a closer including more details about Scott Mason and his team here.

Now watch this!