Used toxic assets, anyone?

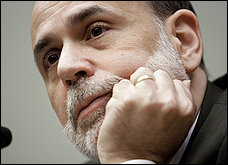

Ben Bernanke, Chairman of the U.S. Federal Reserve, announced that the Fed was likely to begin to sell some of the $1 trillion in mortgages, the so-called “toxic assets,” that it purchased over the last fifteen months to help stave off a total credit market meltdown. Those purchases essentially doubled the U.S. money supply, igniting fears of potential inflation should the underlying real economy recover before the money supply could be drawn back down. See earlier post.

Well, the process of tightening the money supply may be just around the corner. And increases in interest rates and the cost of everything purchased on credit – homes, cars, durable goods, and business capital expenditures – are not far behind. Increases in interest rates dampen economic activity, an unfortunate development given the current lethargic state of the U.S. economy. But it has to be done sometime – we cannot sustain such a huge increase in the money supply without paying an even higher price in terms of inflation and a weak dollar.

It will be interesting to see who buys the toxic assets and how much they will pay. Regardless, the sale will reduce the money supply which, if done in a slow, orderly manner, is a good thing for the economy. Getting the Fed out of the business of buying and selling private market securities will be an even better thing for the U.S. economy. Now more than ever we need a monetary authority that is focused on the best policies for our economy, not those that help Fannie Mae, the White House, or the Treasury Secretary save face.

By Sherry Jarrell